Beyond attribution: Measuring marketing influence in three layers

Marketing budgets in B2B companies range from 6% to 15% of annual revenue, yet we’re stuck in the dark ages when it comes to understanding marketing ROI.

Most companies are still looking at attribution as the only way to assess marketing influence on pipeline and revenue generation.

Even the methodologies for attribution are outdated, with built in confirmation bias.

Furthermore, marketing impact is often dumbed down to a single field, such as Lead Source, Account Source, or Opportunity Source.

Understanding influence today is more nuanced. Three layers tell the full story:

- Journey based attribution

- Engagement

- Counter-ghosting

We’ll look at all three. First, let’s get grounded in why current methods keep ROI difficult to understand.

Problems with outdated attribution

A customer’s buying journey is a nuanced relationship between prospects and vendors comprising many interactions. Just like a relationship between two people, the first interaction leaves an impression (good or bad), but is rarely sufficient to result in a marriage.

Imagine if someone suggested a wedding on a first date. You’d think they were nuts. You’d be right. Same is true for a buying journey for a customer.

The first interaction doesn’t give enough information to make a commitment decision.

There will be follow-on interactions that will either reinforce the first impression or negate it. Each interaction is important based on the new impression it casts. And—this is important but not often talked about—each new interaction is always received in the context of all prior interactions.

This additive journey simply cannot be captured with classic attribution models based on first touch, last touch, u-shapes or any other letter of the alphabet.

As professionals who’ve purchased software from other vendors, we can intuitively say that we don’t classify our experience as being “marketing sourced” or “sales sourced.”

Often, we may start with an outbound email from an SDR who has shared a piece of content we find insightful. That leads to a call with a sales team member who makes a great impression. The product demo, followed by helpful case studies, convinces us that we should purchase this service.

Yet, when we switch roles to be the vendor that’s doing the selling, we feel compelled to make it a binary choice. Lead source = marketing OR SDR OR sales, never all of the above? Why is that?

Problems with not thinking beyond attribution

Attribution is a rearview mirror way to understand a channel or campaign’s impact. It typically only captures a small subset of milestones in the customer’s journey—for example, Lead Creation, Opportunity Creation, Closed Won.

If we only look at a few milestones, we’re denying ourselves a wealth of insight into marketing influence and early signals. Specifically, if a piece of content or a nurture campaign re-engages an opportunity that was unresponsive for weeks, it may not count towards attribution at all, or very little, but the campaign is clearly immensely valuable.

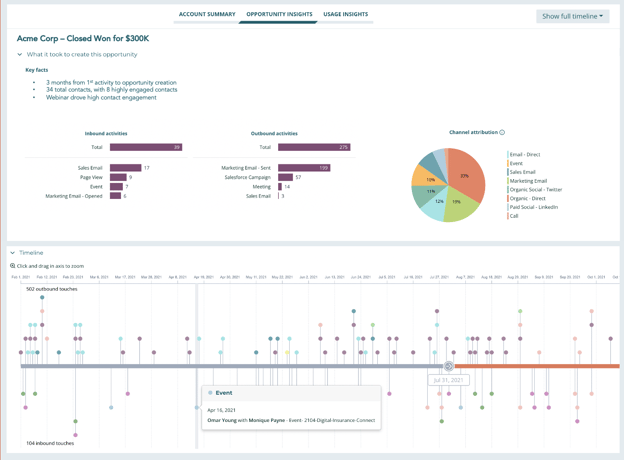

Our approach with customers is to provide a complete picture of marketing influence on revenue generation that considers every touchpoint irrespective of the order they’re encountered. It also looks at each touchpoint’s power to engage and power to interrupt disengagement.

Here’s how we do it.

Journey based attribution

Instead of position based attribution (first/last), we recommend journey based attribution. This attribution is built on the philosophy that all interactions build upon each other and factor into the customer’s purchase decision.

Since journeys result in a LOT of data to understand, it’s important to distinguish the signal from the noise.

There’s a simple and powerful way to do this: if you took all the customer journeys across marketing and sales interactions that resulted in Closed Won and layered them on top of all journeys that resulted in Closed Lost, you would see which interactions made the difference. These touchpoints should get the highest amount of attribution credit.

This approach also minimizes confirmation bias that is prevalent in position based attribution.

“AND instead of OR” approach

Instead of having fields like Lead Source = Marketing or Sales or SDR, we recommend three fields that combine the percentage of influence Marketing, Sales, and SDR activity had on the creation of a lead, opportunity, or revenue.

So, if an opportunity is created via an SDR call, after which the SDR shares a specific piece of marketing content. That content doesn’t inspire action, but the SDR shares another one the next day that does. The prospect books an AE meeting, and then the opportunity is created. The credit for this would be SDR-Sourced = 33%, Marketing-Sourced = 33% (for the second content shared), AE Sourced = 33%.

Guess what. Because this approach accurately depicts what happened to create the opportunity, it results in better decision making on how to generate pipeline AND promotes collaboration instead of tension between teams.

Engagement influence

In addition to attribution for key lifecycle events like Lead Creation, Opportunity Creation and Closed Won, marketing’s influence should be measured by how much it engages contacts within an account.

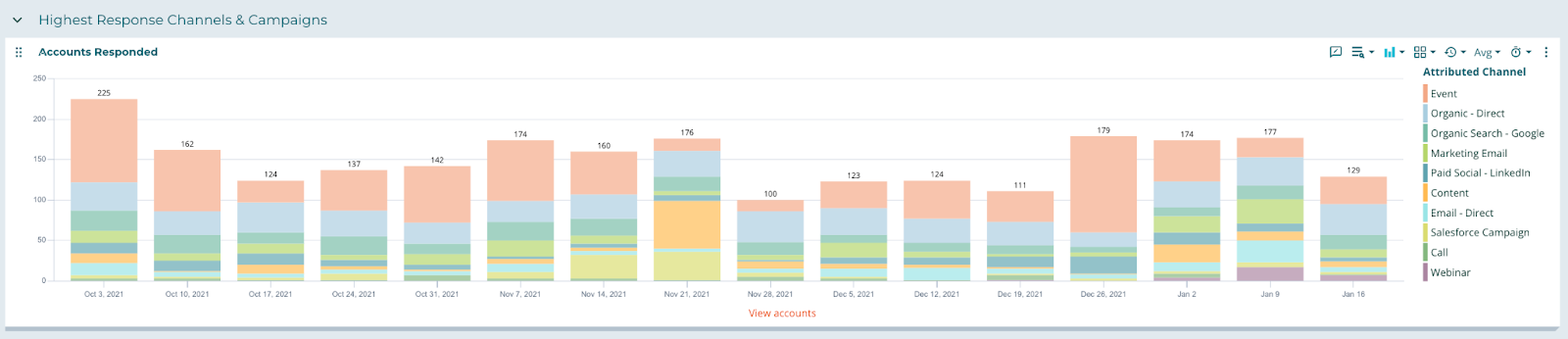

It’s also important to understand which marketing channels and campaigns are driving responsiveness from new contacts and accounts. These may be quite different from the channels and campaigns that are engaging existing accounts and contacts.

To understand what’s actually working, we recommend tracking at the campaign level. The channel is generally sufficient for an everyday view, but you need to be able to get granular to understand your real powerhouse efforts and the ones that may surprise you with actual value versus expectations.

Counter-ghosting influence

It sucks to get ghosted and yet it happens all the time. Revenue pipelines are full of opportunities and contacts that have ghosted us, gone dark, stopped responding.

Marketing tactics are highly effective at re-engaging such prospects yet this is an aspect of marketing influence that’s typically ignored in reporting.

Knowing which channels and campaigns are re-engaging prospects is a cost effective and quick way to improve conversion and deal velocity.

In order to do this correctly, you need to benchmark typical responsiveness at the account and contact level by segment and region. For some segments, it may be typical for an account to see some inbound activity every three days, while others take two weeks.

Based on responsiveness data, accounts that are outside of their benchmark should be considered “disengaged” or “ghosted.”

Then these accounts should be monitored for re-engagement within a look back window and every outbound activity should be examined to understand which one caused re-engagement.

This should be something that can be seen in aggregate (as shown below), or at a segment or even account level.

Takeaway

With journey based attribution, granular engagement data, and counter-ghosting influence, we can understand marketing’s complete influence on pipeline and revenue generation. And that will help us make better budgeting decisions.

Doing this right requires finding meaning in a massive amount of data. The good news is you already have the data. The bummer is it’s probably in siloed between marketing and sales. The first step to making better decisions is unifying your data to make these three layers available to analyze.

Curious about Falkon? Contact us.